TAX TIPS

January 01, 2025

Travel is an essential part of running a business. Whether it's meeting with clients, attending conferences or picking up supplies, business travel is a frequent occurrence for many small business owners, freelancers and contractors.

If you use a personally-owned vehicle (including bicycles) for business travel, make sure you claim all allowable mileage through your company as it's incredibly tax efficient, and can save you a small fortune versus paying for it personally.

But, how do you correctly expense this travel through your limited company? Let's dive into the specifics for cars, vans, motorcycles, and bicycles.

The type of vehicle you use doesn't change the basic principle here: not all journeys are considered business-related. Like all expenditure, you need to be able to justify that the expenditure (i.e. the travel) that is incurred is 'wholly, exclusively and necessarily' for business use. So, if you travelled to meet a prospective client or attending a business conference, these would be good examples of business journeys that you could claim mileage for.

However, the rules are slightly different for traveling to client sites or co-working spaces. These will be allowed as long as they are deemed a temporary workplace and you stay within HMRC's 24 month rule. We'll explain these below:

The claim amount varies based on the mode of transport:

| Vehicle Type | ' ' ' ' ' ' ' 'First 10,000 Miles | ' ' ' ' ' ' ' 'After 10,000 Miles | ' ' ' ' ' '

|---|---|---|

| Car/Van | ' ' ' ' ' ' ' '45p | ' ' ' ' ' ' ' '25p | ' ' ' ' ' '

| Motorcycles | ' ' ' ' ' ' ' '24p | ' ' ' ' ' ' ' '24p | ' ' ' ' ' '

| Bicycles | ' ' ' ' ' ' ' '20p | ' ' ' ' ' ' ' '20p | ' ' ' ' ' '

These rates are designed to cover all associated costs, such as fuel, wear and tear, insurance, and maintenance.

For example: If you've driven 1,000 miles in your car for business purposes, you can claim back £450. Meanwhile, if you've cycled 100 miles to client meetings, you can claim back £20.

Note: All of the costs should all be paid for from your personal account, not from the business account.

Travel expenses can be deducted from your taxable profit, thereby reducing the amount of corporation tax your company owes.

To illustrate: if you drive 1,000 miles and claim £450 for car mileage, this can lead to savings of up to £119.25 in corporation tax (if at the 26.5% marginal corporation tax rate). Scaling this up, if you drive 10,000 miles, you can claim £4,500. This translates to a potential corporation tax saving of up to £1,192.50.

When these travel expenses are correctly claimed, the company can reimburse you (whether you're the director or an employee) entirely tax-free. If you're VAT registered, it's also worth knowing that VAT can be reclaimed on the fuel element of the mileage. HMRC frequently change their rates in this regard, but Mighty will calculate this for you automatically. Please note: if you are reclaiming VAT, you should keep VAT receipts when purchasing petrol.

Furthermore, this system ensures that you aren't dipping into your personal finances to cover the company's travel costs. For example, this could avoid you needing to withdraw dividends (taxed at 8.75%, 33.75% or 39.35%) to pay for travel personally, so it's critical you claim back for every qualifying journey you make, no matter how small.

So how do you actually claim the mileage back, keep track of everything and pay yourself?

Regardless of your mode of transport, to claim back mileage expenses, it's crucial to maintain a comprehensive record of your journey.

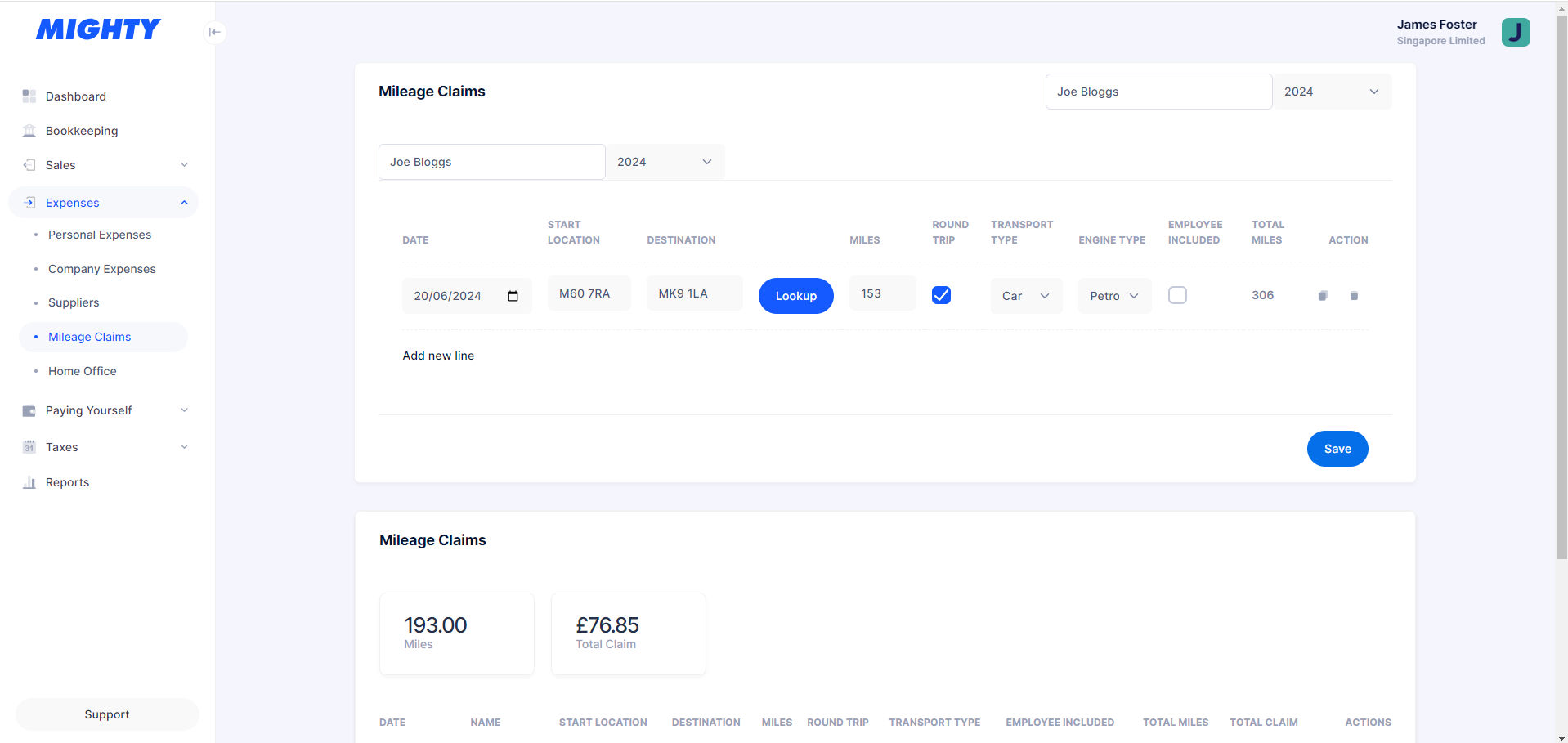

Platforms like Mighty make this a breeze:

Mighty manages the calculations, applies the tax savings, and confirms the amount you can pay yourself tax-free.

When claimed correctly, the business mileage is tax deductible for the company and you won't have to pay tax or national insurance on the amount you reimburse yourself for business travel.

Alternatively, you can use a spreadsheet to detail every trip, then pass this information to your accountant who will typically tell you how much you can pay yourself back once they've done your accounts.

While on a business-related journey, there might be additional costs like parking, tolls, food, or even accommodation. As long as you're on a business-related journey to a temporary location, these costs can typically be expensed through the company.

Unlike the running costs of your vehicle, you can pay for these directly from the business account. If you do mistakenly pay for business expenses through your personal card, you should still claim this back through the business by adding a personal expense.

For freelancers, contractors, and limited company owners, the road is often an extension of the workplace. Whether you're in the saddle, or behind the steering wheel, understanding the tax benefits of your journeys is essential.

Mighty makes tracking and expensing business mileage efficient and straightforward, ensuring compliance and maximising benefits. Take control of your travel expenses with the intuitive tools and expert team at Mighty.